So you’re a salaried worker doing the “right” things. You show up, you get paid, you budget, and you try to keep life running. But sometimes the numbers don’t care about effort. School fees are due. Groceries cost more. The geyser bursts. A medical bill arrives out of nowhere. You apply for a personal loan, and the bank declines.

Maybe it’s a low credit score. Maybe it’s thin credit because you haven’t borrowed much before. Maybe you went through a tough season and missed payments. Either way, the result is the same. You need cash quickly, and traditional lenders won’t help.

Here’s the good news. If you own a fully paid-up vehicle, you may already have what lenders need: security. Pawning your car in Cape Town, with the right provider, can give you access to cash by using your car as collateral, without relying on a perfect credit profile.

This guide explains how pawn and drive options in Cape Town work, what you can use the money for, what you need to qualify, and how to borrow responsibly.

Why Pawn and Drive Works Even With Bad Credit

When banks assess a loan application, they focus heavily on affordability checks and credit history. If your score is poor or your credit profile is thin, you can be declined even with a stable salary.

Pawn and drive works differently. This is asset-based lending, which means the loan decision is based largely on the value of your car, not only your credit record. Your vehicle acts as collateral, which allows lenders to reduce their reliance on credit scoring.

In practice, this means:

- The car’s value reduces the focus on your credit history

- You can access a no-credit-check style solution because approval does not hinge on your credit profile

- The application process is often simpler than a traditional bank loan

For many people, this creates breathing room when other options are closed. In Cape Town, borrowers often choose pawn and drive because it’s practical. You can access cash while still keeping your car on the road, which allows you to commute to work, handle school runs, and manage daily responsibilities.

If you’re searching terms like “pawn my car Cape Town,” “bad credit car loan Cape Town,” or “loan against car papers Cape Town,” you’re not alone, and you’re not out of options.

What You Can Use the Cash For

Most people don’t choose pawn and drive for luxury spending. They use it to cover real-life expenses that can’t wait. Common uses include:

School fees and education

- Tuition and registration

- Uniforms, stationery, and transport

- College or short-course payments

Medical expenses

- Doctor visits, medication, dental work

- Emergency or unexpected treatment

- Supporting a family member who needs care

Home and household costs

- Rent top-ups

- Electricity, water, and rates

- Repairs, appliances, or essential upgrades

Transport-related expenses

- Fuel, insurance, brakes, or tyres

- Mechanical repairs to keep the car reliable

- Covering a short gap before payday

Unexpected emergencies

- Funeral costs

- Family crisis travel

- Urgent repairs that can’t be delayed

Step-by-Step: How to Pawn Your Car in Cape Town

If you’ve never done this before, it’s normal to feel cautious. A reputable provider will keep the process straightforward and transparent. Here’s how it typically works:

Step 1: Submit your car details

You’ll share basic information such as the make, model, year, mileage, and general condition. This can usually be done online, via WhatsApp, over a call, or in person.

Step 2: Get a valuation

The lender assesses your vehicle to determine a fair loan amount based on its condition and market value.

Step 3: Review and sign a clear agreement

You’ll receive a written agreement outlining:

- The loan amount

- Repayment terms and duration

- Interest, fees, and any admin costs

- What happens if payments are missed

Take time to read this carefully and ask questions before signing.

Step 4: Finalise documents and receive payment

Once everything is approved and verified, the payout is arranged.

Step 5: Drive away with your car and your cash

This is what makes pawn and drive so useful. You access funds without losing your daily transport.

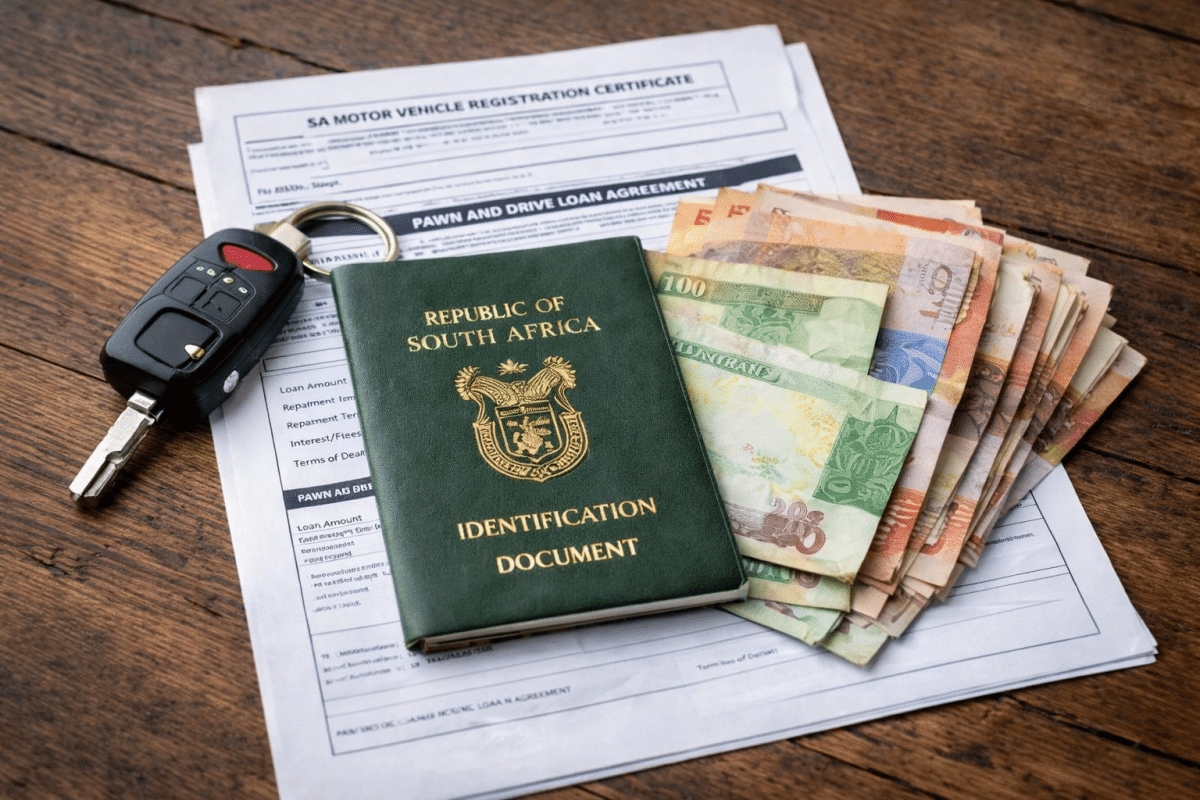

Cape Town Requirements: What You Need to Qualify

While each provider has their own process, the requirements are usually simple. To qualify for a loan against car papers in Cape Town, you generally need:

- A car that is fully paid up, with no outstanding finance

- A valid South African ID

- Vehicle registration documents

- Proof of ownership, with the car registered in your name

- A basic application form with personal and vehicle details

Tip: If a provider cannot clearly explain what documents they need, or pressures you to sign without proper paperwork, that’s a red flag.

Why This Is Safer Than Informal Loans

When you’re under pressure, informal lenders can feel like the fastest option. Unfortunately, fast often becomes expensive and stressful.

A structured, regulated approach offers important protections.

Protection under the National Credit Act

A legitimate lender should operate in compliance with the NCA. You should receive documentation that clearly outlines your rights and responsibilities.

Regulated agreements

You’re not relying on verbal promises. The terms are written, reviewable, and enforceable.

Transparent fees

Reputable providers explain costs upfront, with no surprise charges later.

Professional conduct

Informal loans can involve intimidation, changing terms, or added fees when you’re already stuck. A compliant provider keeps the process predictable and respectful.

Practical Tips for Borrowing Responsibly

A pawn and drive loan can be helpful when used wisely.

Borrow only what you need

It can be tempting to take the maximum offered. Borrowing only what solves the immediate problem keeps repayments manageable.

Understand the repayment structure

Before signing, make sure you’re clear on:

- The monthly repayment amount

- The full repayment term

- The total cost over time

- Settlement rules, including early repayment options

Review the contract carefully

Read it slowly and compare the terms to your budget. Ask questions if anything is unclear.

Keep communication open

If you anticipate a tough month, communicate early. Planning ahead is far more effective than avoiding contact.

A Practical Option When the Bank Says No

If you’re a salaried worker with bad or thin credit, you don’t need another rejection. You need a solution that works with what you already have. Your car is an asset, and it can help you access cash when traditional lenders won’t.

If you’re exploring pawn and drive options in Cape Town, make sure you choose a transparent, compliant provider who explains every step before you commit.Need fast cash, but the bank said no? Apply with Pawn and Drive Cape Town today.